In earlier versions of CA Business Service Insight, there were contract entities known as Penalties which were implemented using Excel-like formulas. Penalties based their results solely on the input from the contract's Metrics and relied on basic functions to calculate the resulting penalty amount. From version 4.0 and up, these have been replaced by full Financial Metrics which can be created by the user, allowing greater flexibility. These financial Metrics can be used to provide Incentive or Cost information about the contract.

Note: An Incentive replaces the old Penalty terminology from CA Business Service Insight 3.0 and earlier, and can be positive or negative depending on performance. A negative Incentive however, is basically just the same as a penalty. It is also important to note that if you are implementing a Penalty with the Incentive Metric Type, you must remember to make the Result() function return a negative value. This enables any summarizing functions which may combine different Metrics results together, to adjust the totals in the right direction. Tha is, an incentive increases the value whereas a penalty decreases it.

CA Business Service Insight version 4.0 also provides the ability to create a Consumption Metric measuring the usage of service components and resources, and also to combine this with a Price Item Metric to determine the cost of that service or resource. Combining these with the enhanced forecasting functionality makes it now possible to create some very comprehensive Financial Management Metrics.

Financial Metrics can also acquire the output from other Contractual Metrics and determine the related Penalty or Incentive values based upon the performance of these contractual Metrics. They can also work with other types of information to determine their result, such as Price per Unit information and forecasting models enabling reporting functionality such as Expected vs. Actual Costs.

Cost Item Example:

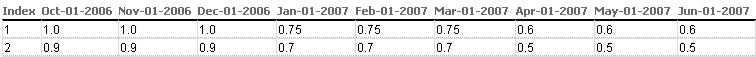

A particular Risk Application has an associated cost based on the number of concurrent users of the system. It is calculated monthly and there is a forecasted value provided for this application. The price per unit of this application (cost per concurrent user) is provided in the table below (assume this application falls under index 1):

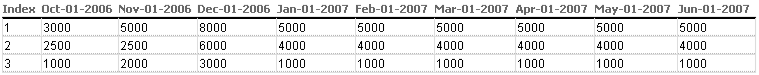

The forecasted number of concurrent users for this period is also available (Again, index 1).

By modeling this Cost Metric using these costing tables it is possible to determine the monthly application cost, based upon the actual number of concurrent users. This information comes from the data-source and can be multiplied by the price-per-unit figures above to give the Cost figures. It can also be compared to the forecasted values to provide an analysis of the expected vs. actual cost. The Business Logic in this case is required to determine the actual number of concurrent users encountered during the period and multiply it by the cost per unit values. In addition, the forecast function within the Business Logic refers to the Forecast information. This is an example of applying a Cost Item metric.

Penalty scenario Example:

The customer SLA has a nonperformance clause included in it to ensure that the network is available 98% of the time for any given month during business hours. Any monthly service level below this incurs a penalty payment based upon a formula (Penalty = $1000 per each whole percentage below the target (i.e. 96.5% = (98-Round(96.5)) * 1000 = (98-97) * 1000 = -$1000)).

In order to implement this penalty condition, you can create a Financial Incentive metric which takes its input from an existing metric (Network Availability >= 98% ) The registration process for this Metric uses the RegisterByMetric() process to receive the service level values from that Metric in order to perform the comparisons. This sends the service level values for the tracking period of that Metric into this financial metric as events which are then used as part of the calculation to determine the Penalty amount for that same period using the formula from the scenario.

Note: For further case studies, refer to the Financial Metric Modeling Case Study.

|

Copyright © 2012 CA.

All rights reserved.

|

|