Use the following financial metrics to evaluate your spending on individual investments and decide on investments that you want to pursue at the portfolio level:

Example: Using Financial Metrics to Make Funding Decisions

Executives and senior management want to make funding decisions for the fiscal year based on IRR, MIRR, and Payback Period for individual projects. The project manager uses a cost plan to create cost projections for three projects that are being proposed. The project manager also uses a benefit plan to create benefit projections for two of the projects. The benefit plans are associated with the corresponding cost plans. For the third project, a financial summary is used to capture projected costs and benefits for a given time frame. Senior management creates a portfolio that includes all the projects and completes the following steps:

The following financial metrics are available to help you evaluate your plans:

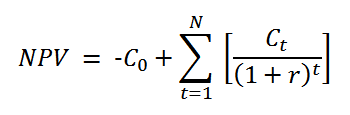

Displays the net present value of this investment by calculating the total cost of capital and a series of future payments and income. This metric is calculated using the following formula:

Where

t represents the time period of the cash flow in months

N represents the total time of the project

r is the discount rate of return that can be earned on investments with similar risks

C0 is the initial investment cost (expressed as a negative number)

Ct is the net cash flow or the amount of cash for time t (in months)

Displays the ratio of money gained or lost on this investment relative to the amount of money invested. This metric is calculated using the following formula:

ROI = (Total Planned Benefit - Total Planned Cost)/(Total Planned Cost)

Where

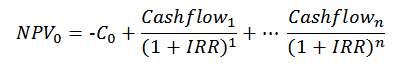

Displays the Internal Rate of Return or the discount rate used to achieve zero NPV for an investment. Use IRR as an alternate method for evaluating an investment without estimating the discount rate. The application uses the following rules to calculate IRR:

This metric is calculated using the following formula:

Where

C0 is the initial investment cost (expressed as a negative number).You can define this value using the Initial Investment field on the budget properties page of an investment.

n represents the number of periods available in the cash flow.

Cash flow starts with the first fiscal time period of the cost plan or the associated benefit plan, whichever is earlier, and ends with the last fiscal time period of the cost plan or the associated benefit plan, whichever ends later. The cash flow for each fiscal time period equals the projected benefit less the available cost for that period. If benefit or cost is unavailable for a given fiscal time period, zero dollars is used.

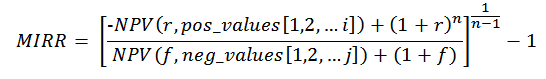

Displays the Modified Internal Rate of Return or the rate used to measure the attractiveness of this investment. Use MIRR as part of a capital budgeting process to rank various alternative investment choices. While IRR assumes the cash flows from an investment are reinvested at the IRR, the MIRR assumes that all cash flows are reinvested at the cost of capital. The application uses the following rules to calculate MIRR:

This metric is calculated using the following formula:

Where

r is the annual interest rate for reinvesting the positive cash flow. You can define this value using the Reinvestment Rate field on the budget properties page of an investment. If this value is not defined for an investment, r is zero.

f is the annual finance rate on the capital borrowed for investments. You can define this value using the Total Cost of Capital field on the budget properties page of an investment.

n represents the last period in the lifetime of the investment (n=i+j).

Displays the date when the expected cash flow equals the cash outlay for an investment. The breakeven date matches with the payback period.

Displays the number of periods (in months) needed for the sum of the expected cash flows to equal the initial cash outlay for an investment. The payback period matches with the breakeven date and considers the initial investment value. This value is part of the cost included in the first period of a given time period.

Payback Period is derived as one of the following:

|

Copyright © 2015 CA Technologies.

All rights reserved.

|

|