Chargebacks represent the inter-account transfers of investment or service costs to departments. Chargebacks debit (or charge) departments for their shared cost of investments or services that were delivered during a specified period. A chargeback represents the debit-side of an accounting system. A corresponding credit is issued to departments that provide the investment or service crediting them for the work they completed during a specified period.

To process chargeback transactions, set up general ledger accounts and create chargeback rules, such as standard debit rules, credit rules, or overhead rules. The rules you create depend on the type of chargeback processing you want to implement.

Rules drive chargebacks and credits and determine the shared costs of investments and services. A chargeback rule is a set of unique properties that are matched to transactions when debiting and crediting departments. Chargeback rules are composed of:

Example: Sharing Costs

Retail Banking of Forward Inc commissioned the development of a mortgage application whose systems are shared by Retail Self Services and Retail Premier Accounts. Retail Banking is using the Chargeback feature to allocate costs incurred by IT for this development project.

This project required expertise from application developers, analysis expertise from Retail IT technical operators, and technical securities expertise from Investment Banking IT. Retail Banking IT set up investment-specific debit rules and credit rules to charge back costs to departments that commissioned the work and credit those that provided the work.

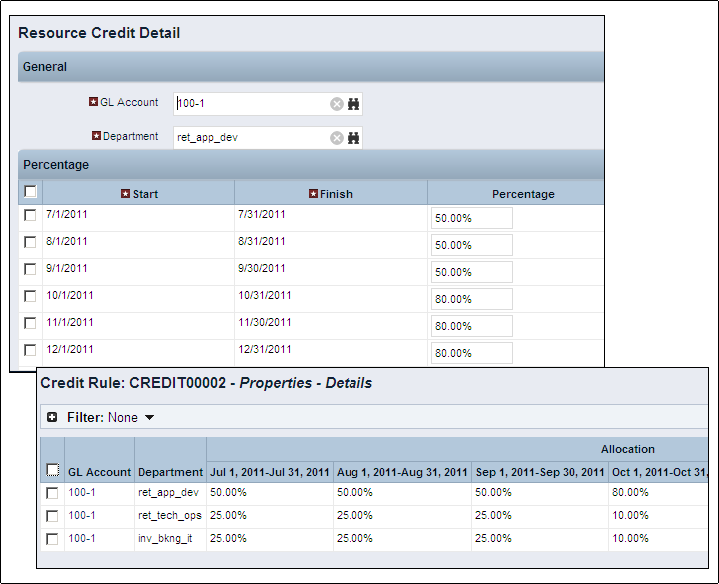

Crediting Multiple IT Departments for Work Completed

The Retail IT finance manager set up a credit rule to allocate 100 percent credit among three provider departments:

Retail Application Development is doing the bulk of the development work and is credited 50 percent for the first three months and 80 percent for the remaining three months.

Retail Technical Operation is providing consultation at the beginning of the project and is credited for 25 percent for the first three months, and 10 percent for the remaining three months.

Investment Banking IT is also providing consultation at the beginning of the project and is credited for 25 percent for the first three months and 10 percent for the remaining three months.

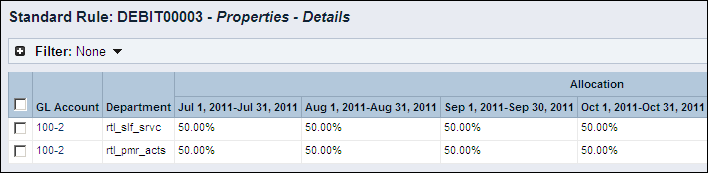

Debiting Multiple Business Units for Commissioned Work

The Retail IT project manager for this project set up a debit rule to charge back 50 percent each quarter to the Retail Self Service department and Retail Premier Accounts department.

With flexible chargeback rules, Forward Inc can allocate charge costs appropriately to the departments benefiting from the services IT is providing. It also enables IT departments to get credit for the work they deliver.

|

Copyright © 2015 CA Technologies.

All rights reserved.

|

|